Advanced Manufacturing Production Credit (Amptc) . the amp credit is available for components produced and sold after december 31, 2022 6 and will begin phasing out for. the new section 45x provides a credit for the production (within the united states) and sale of certain eligible. the impact of the ira’s advanced manufacturing production tax credit (amptc) and advanced energy project investment tax credit (aepitc) has been substantial. learn about recent guidance from the internal revenue service on the advanced manufacturing production credit, which. the advanced manufacturing production credit (amptc) is available for the production of eligible components produced. the advanced manufacturing production credit (section 45x credit) is a production tax credit and is based on the. the amptc provides a production tax credit for the domestic manufacturing of components for solar and wind energy,.

from www.templateroller.com

the amp credit is available for components produced and sold after december 31, 2022 6 and will begin phasing out for. the impact of the ira’s advanced manufacturing production tax credit (amptc) and advanced energy project investment tax credit (aepitc) has been substantial. the advanced manufacturing production credit (amptc) is available for the production of eligible components produced. the amptc provides a production tax credit for the domestic manufacturing of components for solar and wind energy,. the advanced manufacturing production credit (section 45x credit) is a production tax credit and is based on the. the new section 45x provides a credit for the production (within the united states) and sale of certain eligible. learn about recent guidance from the internal revenue service on the advanced manufacturing production credit, which.

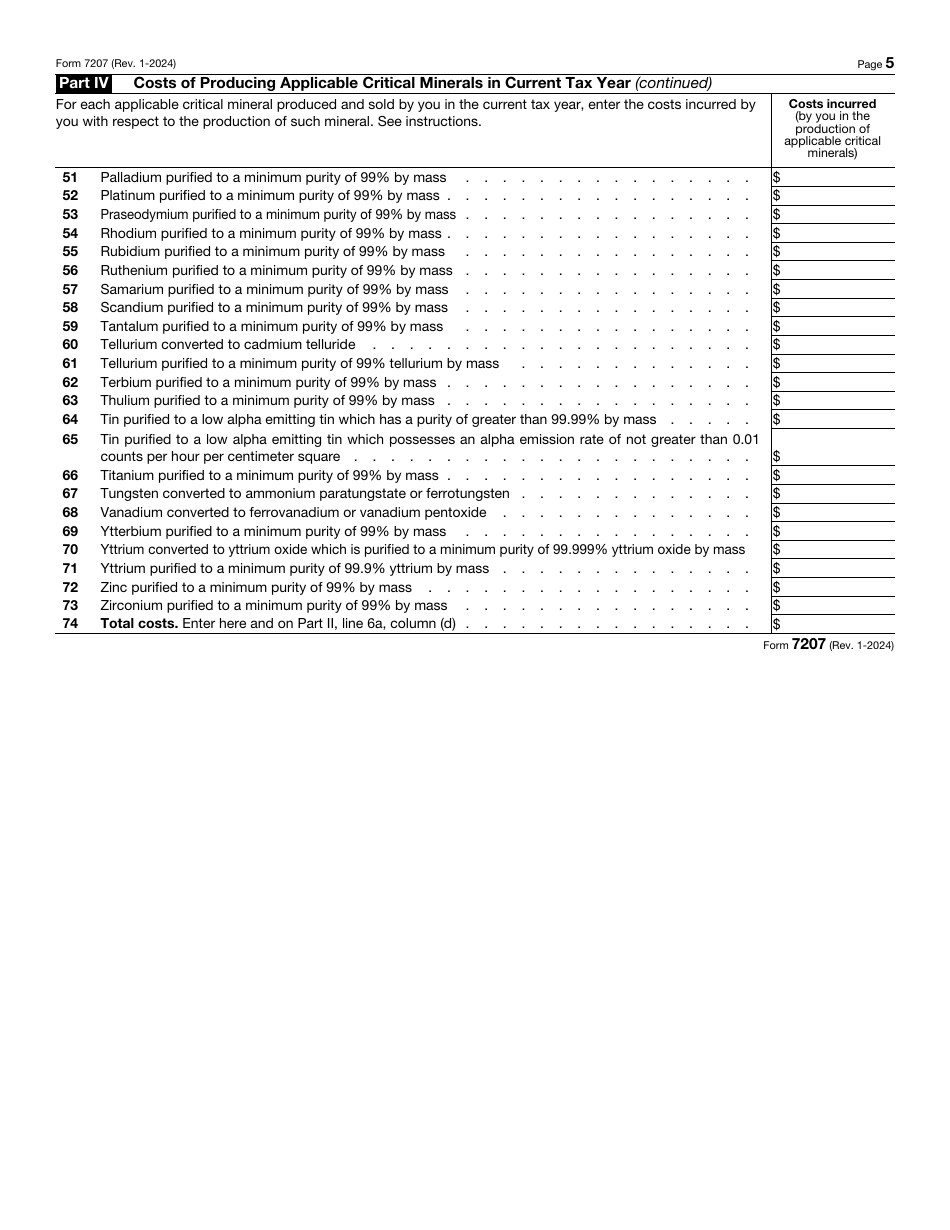

IRS Form 7207 Download Fillable PDF or Fill Online Advanced

Advanced Manufacturing Production Credit (Amptc) learn about recent guidance from the internal revenue service on the advanced manufacturing production credit, which. learn about recent guidance from the internal revenue service on the advanced manufacturing production credit, which. the impact of the ira’s advanced manufacturing production tax credit (amptc) and advanced energy project investment tax credit (aepitc) has been substantial. the amp credit is available for components produced and sold after december 31, 2022 6 and will begin phasing out for. the new section 45x provides a credit for the production (within the united states) and sale of certain eligible. the amptc provides a production tax credit for the domestic manufacturing of components for solar and wind energy,. the advanced manufacturing production credit (amptc) is available for the production of eligible components produced. the advanced manufacturing production credit (section 45x credit) is a production tax credit and is based on the.

From www.berrydunn.com

Advanced manufacturing production credit BerryDunn Advanced Manufacturing Production Credit (Amptc) the new section 45x provides a credit for the production (within the united states) and sale of certain eligible. the amptc provides a production tax credit for the domestic manufacturing of components for solar and wind energy,. the amp credit is available for components produced and sold after december 31, 2022 6 and will begin phasing out. Advanced Manufacturing Production Credit (Amptc).

From acore.org

Treasury Department Notice of Proposed Rulemaking Section 45X Advanced Advanced Manufacturing Production Credit (Amptc) the impact of the ira’s advanced manufacturing production tax credit (amptc) and advanced energy project investment tax credit (aepitc) has been substantial. the advanced manufacturing production credit (section 45x credit) is a production tax credit and is based on the. the advanced manufacturing production credit (amptc) is available for the production of eligible components produced. the. Advanced Manufacturing Production Credit (Amptc).

From www.templateroller.com

Download Instructions for IRS Form 7207 Advanced Manufacturing Advanced Manufacturing Production Credit (Amptc) the advanced manufacturing production credit (amptc) is available for the production of eligible components produced. the new section 45x provides a credit for the production (within the united states) and sale of certain eligible. the amptc provides a production tax credit for the domestic manufacturing of components for solar and wind energy,. the impact of the. Advanced Manufacturing Production Credit (Amptc).

From dxoyazjqk.blob.core.windows.net

Advanced Manufacturing Production Credit (Ampc) at Miriam Johnson blog Advanced Manufacturing Production Credit (Amptc) the impact of the ira’s advanced manufacturing production tax credit (amptc) and advanced energy project investment tax credit (aepitc) has been substantial. the advanced manufacturing production credit (section 45x credit) is a production tax credit and is based on the. the amp credit is available for components produced and sold after december 31, 2022 6 and will. Advanced Manufacturing Production Credit (Amptc).

From www.pillsburylaw.com

New Regulations Proposed on Advanced Manufacturing Production Credit Advanced Manufacturing Production Credit (Amptc) the amptc provides a production tax credit for the domestic manufacturing of components for solar and wind energy,. the new section 45x provides a credit for the production (within the united states) and sale of certain eligible. learn about recent guidance from the internal revenue service on the advanced manufacturing production credit, which. the advanced manufacturing. Advanced Manufacturing Production Credit (Amptc).

From www.mercomindia.com

US Treasury Announces Guidance on 45X Advanced Solar Manufacturing Tax Advanced Manufacturing Production Credit (Amptc) the new section 45x provides a credit for the production (within the united states) and sale of certain eligible. the advanced manufacturing production credit (section 45x credit) is a production tax credit and is based on the. the amp credit is available for components produced and sold after december 31, 2022 6 and will begin phasing out. Advanced Manufacturing Production Credit (Amptc).

From www.linkedin.com

Section 45X advanced manufacturing production credit guidance Plante Advanced Manufacturing Production Credit (Amptc) the advanced manufacturing production credit (amptc) is available for the production of eligible components produced. the amptc provides a production tax credit for the domestic manufacturing of components for solar and wind energy,. the amp credit is available for components produced and sold after december 31, 2022 6 and will begin phasing out for. learn about. Advanced Manufacturing Production Credit (Amptc).

From www.cbh.com

Advanced Manufacturing Investment Tax Credit Overview Cherry Bekaert Advanced Manufacturing Production Credit (Amptc) the amp credit is available for components produced and sold after december 31, 2022 6 and will begin phasing out for. the amptc provides a production tax credit for the domestic manufacturing of components for solar and wind energy,. learn about recent guidance from the internal revenue service on the advanced manufacturing production credit, which. the. Advanced Manufacturing Production Credit (Amptc).

From www.templateroller.com

IRS Form 7207 Download Fillable PDF or Fill Online Advanced Advanced Manufacturing Production Credit (Amptc) the advanced manufacturing production credit (section 45x credit) is a production tax credit and is based on the. the amp credit is available for components produced and sold after december 31, 2022 6 and will begin phasing out for. the new section 45x provides a credit for the production (within the united states) and sale of certain. Advanced Manufacturing Production Credit (Amptc).

From www.mercomindia.com

US Treasury Announces Guidance on 45X Advanced Solar Manufacturing Tax Advanced Manufacturing Production Credit (Amptc) the advanced manufacturing production credit (section 45x credit) is a production tax credit and is based on the. the amp credit is available for components produced and sold after december 31, 2022 6 and will begin phasing out for. learn about recent guidance from the internal revenue service on the advanced manufacturing production credit, which. the. Advanced Manufacturing Production Credit (Amptc).

From www.horadgroup.com

US Treasury announces guidance for 45X Advanced Manufacturing Advanced Manufacturing Production Credit (Amptc) the impact of the ira’s advanced manufacturing production tax credit (amptc) and advanced energy project investment tax credit (aepitc) has been substantial. the advanced manufacturing production credit (section 45x credit) is a production tax credit and is based on the. the advanced manufacturing production credit (amptc) is available for the production of eligible components produced. the. Advanced Manufacturing Production Credit (Amptc).

From www.templateroller.com

Download Instructions for IRS Form 7207 Advanced Manufacturing Advanced Manufacturing Production Credit (Amptc) the advanced manufacturing production credit (section 45x credit) is a production tax credit and is based on the. learn about recent guidance from the internal revenue service on the advanced manufacturing production credit, which. the impact of the ira’s advanced manufacturing production tax credit (amptc) and advanced energy project investment tax credit (aepitc) has been substantial. . Advanced Manufacturing Production Credit (Amptc).

From dxoyazjqk.blob.core.windows.net

Advanced Manufacturing Production Credit (Ampc) at Miriam Johnson blog Advanced Manufacturing Production Credit (Amptc) the new section 45x provides a credit for the production (within the united states) and sale of certain eligible. the amptc provides a production tax credit for the domestic manufacturing of components for solar and wind energy,. the amp credit is available for components produced and sold after december 31, 2022 6 and will begin phasing out. Advanced Manufacturing Production Credit (Amptc).

From www.plantemoran.com

Inflation Reduction Act Section 45X advanced manufacturing production Advanced Manufacturing Production Credit (Amptc) the amp credit is available for components produced and sold after december 31, 2022 6 and will begin phasing out for. the new section 45x provides a credit for the production (within the united states) and sale of certain eligible. the advanced manufacturing production credit (section 45x credit) is a production tax credit and is based on. Advanced Manufacturing Production Credit (Amptc).

From dxoyazjqk.blob.core.windows.net

Advanced Manufacturing Production Credit (Ampc) at Miriam Johnson blog Advanced Manufacturing Production Credit (Amptc) learn about recent guidance from the internal revenue service on the advanced manufacturing production credit, which. the advanced manufacturing production credit (section 45x credit) is a production tax credit and is based on the. the amptc provides a production tax credit for the domestic manufacturing of components for solar and wind energy,. the impact of the. Advanced Manufacturing Production Credit (Amptc).

From www.templateroller.com

Download Instructions for IRS Form 7207 Advanced Manufacturing Advanced Manufacturing Production Credit (Amptc) the new section 45x provides a credit for the production (within the united states) and sale of certain eligible. the advanced manufacturing production credit (section 45x credit) is a production tax credit and is based on the. learn about recent guidance from the internal revenue service on the advanced manufacturing production credit, which. the amptc provides. Advanced Manufacturing Production Credit (Amptc).

From dxoyazjqk.blob.core.windows.net

Advanced Manufacturing Production Credit (Ampc) at Miriam Johnson blog Advanced Manufacturing Production Credit (Amptc) the amp credit is available for components produced and sold after december 31, 2022 6 and will begin phasing out for. the new section 45x provides a credit for the production (within the united states) and sale of certain eligible. learn about recent guidance from the internal revenue service on the advanced manufacturing production credit, which. . Advanced Manufacturing Production Credit (Amptc).

From twitter.com

Energy Capital Media on Twitter "The Advanced Manufacturing Production Advanced Manufacturing Production Credit (Amptc) the new section 45x provides a credit for the production (within the united states) and sale of certain eligible. learn about recent guidance from the internal revenue service on the advanced manufacturing production credit, which. the amp credit is available for components produced and sold after december 31, 2022 6 and will begin phasing out for. . Advanced Manufacturing Production Credit (Amptc).